Truck drivers have unique health concerns. An NIOSH survey found that 50% are smokers and 70% are obese. They’re prone to heart disease, diabetes, high blood pressure, kidney failure, back problems, and motor vehicle accidents related to fatigue and stress. These problems can lead to a loss of their Medical Examiner’s Certificate and their CDLs. You want your staff to … Read More

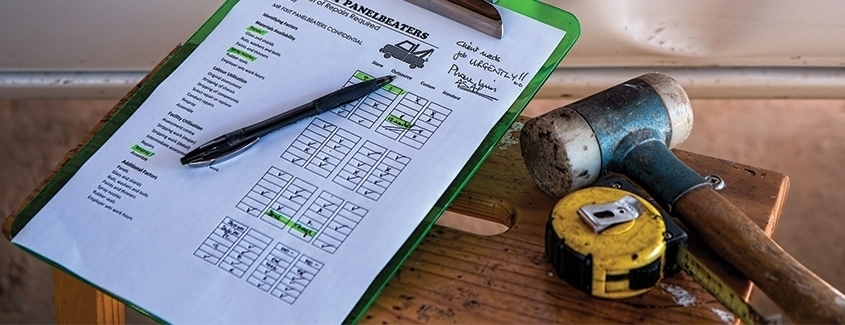

Contractors: Get your subcontractor insurance house in order!

It’s a tough landscape for the building trades in Connecticut. Jobs are out there, but bidding is competitive and margins are tight. We’re nearly 10 years past its beginning, but we’re still not fully recovered from the Great Recession that wiped out trillions of dollars in real estate equity. Given that reality, it doesn’t surprise me when a construction firm … Read More

8 Steps to Vet Construction Subcontractors

As a general contractor, it’s likely that you’ll use subcontractors at some point. Subcontractors can be an efficient way to outsource work. As specialists, they’ll often do a better job than a generalist and their smaller size means they can work quicker and leaner. However, the construction job is your responsibility. The performance of the subcontractor will reflect on you. … Read More